Sports Cards Rise as Alternative Investment Option

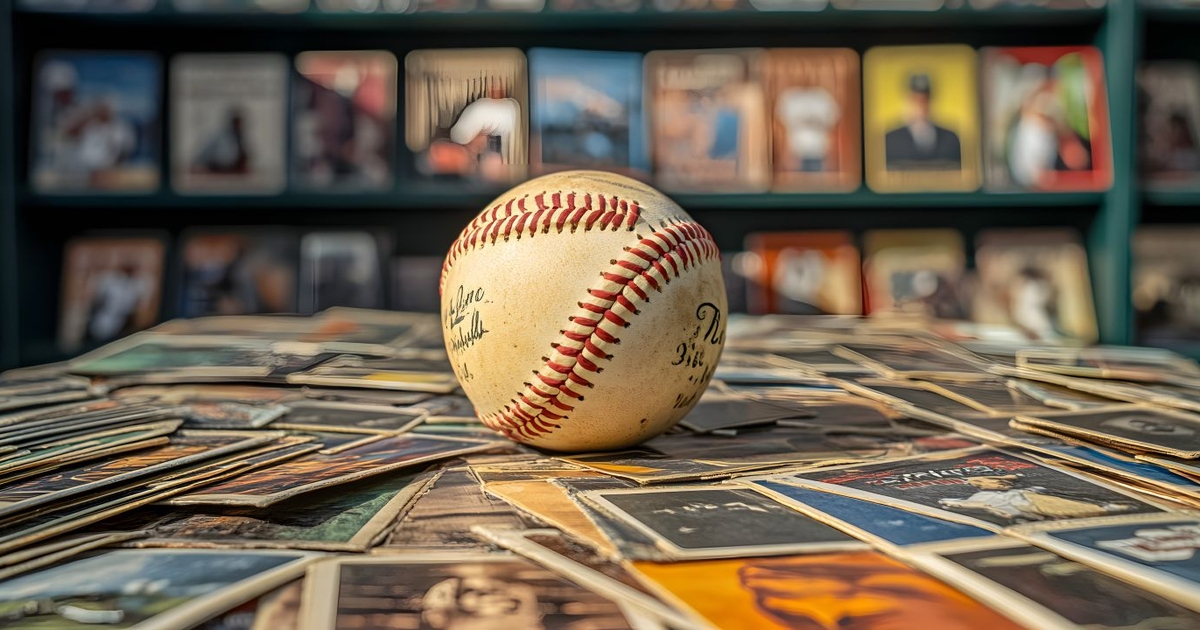

Growing up as a kid, I invested all my hard-earned money from mowing lawns into sports cards—everything from baseball to basketball to football cards. My fervor for collecting cards grew and led me to attend card shows at our local mall, eventually hosting a booth with a friend at those same shows, hoping to land a Ken Griffey Jr. rookie card or the Billy Ripken error card. My collection has never been the best as I didn’t have the money to make it more than just a hobby. However, I was able to turn a handful of good cards into a Michael Jordan rookie card, which I still have today. I also collected my favorite players like Emmitt Smith, Troy Aikman, Kirby Puckett and others. I looked for rookie cards that I thought might be undervalued and bona fide stars—remember Greg Jeffries? Looking back, that collection strategy might have foreshadowed my investment philosophy of locating undervalued companies with good fundamentals and strong growth potential. However, the wax junk era of the 80s didn’t result in a lot of 10-baggers for me.

After over 30 years of neglect, my interest in collecting sports cards has been rekindled.

After a fun Little League season, my 8-year-old son, Oliver, found his love for baseball. We went to practice 30 minutes early so we could just play catch and talk. We went to the park on his off days to get some extra swings in and work on his pitching. We continue to play ball despite frost on the fields and wearing multiple layers of clothes, as we try to squeeze in as many days as we can before the snow flies.

Oliver’s love for baseball has led to a passion for baseball cards that trumps mine as a kid. I bought him his first pack while on vacation when he was 6. He thought it was fun, and he got an Aaron Judge in the pack. But he didn’t really look at them again until his enthusiasm for the game exploded this summer. We went back to visit Grandma this summer and despite his excitement seeing her and numerous cousins, all Oliver wanted to do was look at my collection. After arriving and giving hugs and saying “Hi,” he sprinted upstairs and spent hours thumbing through every one of my thousands of cards my mom kept stored under my old twin bed. He was stoked to find some Clemons, Pucketts, McGwires, Mattinglys, Jacksons, Sanders and the list goes on and on.

Now, the hobby has taken over our household. Oliver’s excitement for cards has rekindled my interest and even made an ardent collector out of his bonus mom, Mae.

The industry has changed tremendously since my childhood. Now there are unique parallels, chrome, refractors, different colors, limited prints, cards with embedded relics and different subsets of cards. You can also choose from individual packs, value boxes, blasters, mega boxes or hobby boxes. But the biggest difference between then and now are the PRICES and, maybe most importantly, no GUM!

Despite all the talk about historically high inflation over the past few years, the increased cost of trading cards never made headlines. Back in 1989, at the height of the wax junk era, I was able to get a pack of Topps baseball cards for roughly $0.50. A pack included 15 cards and that piece of dry, brittle gum. Today, a very similar pack of Topps baseball cards, which includes 14 cards, costs roughly $6.99, and we don’t even get a piece of gum!

The cost of a pack of baseball cards has increased approximately 7.76% annually since 1989, and that $0.50 is now worth approximately $1.30 today. Meanwhile, the average annual rate of CPI during that same time is 2.70%.

Much like investing in art and other collectables, trading cards are also part of the alternative asset class of collectables. Earlier this year, the Shark Tank’s Kevin O’Leary was part of a group of buyers of a 2007-2008 Upper Deck Kobe Bryant/Michael Jordan card. The price tag? $13 million! This was also a sign of how popular trading cards, particularly Pokémon cards, have become. In fact, August marked the single best month ever recorded for online sports trading card sales, with collectors spending over $416 million.

As someone who has a keen interest for both investments and sports trading cards, I am a little more skeptical of the investment viability of sports cards. While I believe there are some cards that could be a prudent part of the alternative asset class within an investment portfolio, the number of those cards is limited. The value of a card is determined by supply and demand basics, card condition, how much a person is willing to pay for that card, and, most importantly, that player must have a successful or even Hall of Fame career. So, you better hope that young player who you think is a bona fide star doesn’t get a career-hampering injury.

As one trading card enthusiast told me—Pokémon’s Pikachu and Charizard cannot tear an ACL or get a concussion. Point taken.

Like other popular alternative investments like private equity, valuations can be difficult. Oliver, Mae and I typically peruse the sold listings on eBay to determine an approximate value. PriceCharting.com is another source collectors use to value trading cards, particularly Pokémon cards. Additionally, the value greatly depends on whether the card is graded, which is another cost a collector must eat if they want to get the most value out of their card.

Like many other alternative investments, liquidity is a risk. The most fluid market for selling /buying sports cards is most likely eBay. You might be able to go to a large card show or even a local card shop but those aren’t guaranteed.

These are some of the reasons I believe sports cards are better suited as a passion-driven hobby with the potential for financial gains as a bonus rather than an investment strategy. Thankfully, I didn’t bank my retirement on sports cards, as the majority did not keep up with inflation over the years. However, there are some instances where it can be a solid investment. And there’s always a chance you can pull a limited autographed rookie chrome Roki Sasaki from a random pack of cards. Which can make the chase worth it.

As a family, collecting sports cards is so much more than a hobby or an investment. It’s about connections. It brings our family together—whether it’s bragging about who has the best cards, trading or just sitting around reading the career statistics on the back of a card and wondering how Nolan Ryan never won a Cy Young—all while Mae is trying to figure out the quickest way to turn a profit. Each one of us has our favorite baseball card shop. Mae’s favorite is down in Folsom, while Oliver and I often make the trek down to Sierra Nevada Sports Collectables in Carson City, where the owner Don, and Oliver, who are roughly 60 years apart in age, spend a couple of hours talking about players like Ruth, Young, Mays, Mathewson, Mantle, Gehrig, Gibson, Fox, Carew and Koufax while thumbing through boxes and boxes of cards looking for a treasure. We often talk about the impact Jackie Robinson had on all sports, which results in us giving thanks to his bravery. Each night after school, if we are not playing catch, we get out our binders and boxes of cards and just sit there, talking about baseball players past and present.

Oliver at Sierra Nevada Sports Collectables

For some, sports cards are simply a hobby—in the chase of the rare card or collecting your favorite player. Others include it in their investment strategy, while for some it is so much more. While this family hobby isn’t likely to make us rich in dollar sense—in fact, it’s more likely to make us poor—it has brought endless amounts of joy and memories for our family which, for us is more valuable than money. Now you all know what is currently sitting under our Christmas tree this year!

Zephyr, is an award-winning asset and wealth management software that offers portfolio construction, proposal generation, advanced analytics, asset allocation, manager screening, risk analysis, portfolio performance and more, transforming multifaceted data into digestible intel.

Ryan Nauman is the Market Strategist at Zephyr, which helps investment professionals make more informed investment decisions on behalf of their clients. Connect with Ryan on LinkedIn.

Post Comment