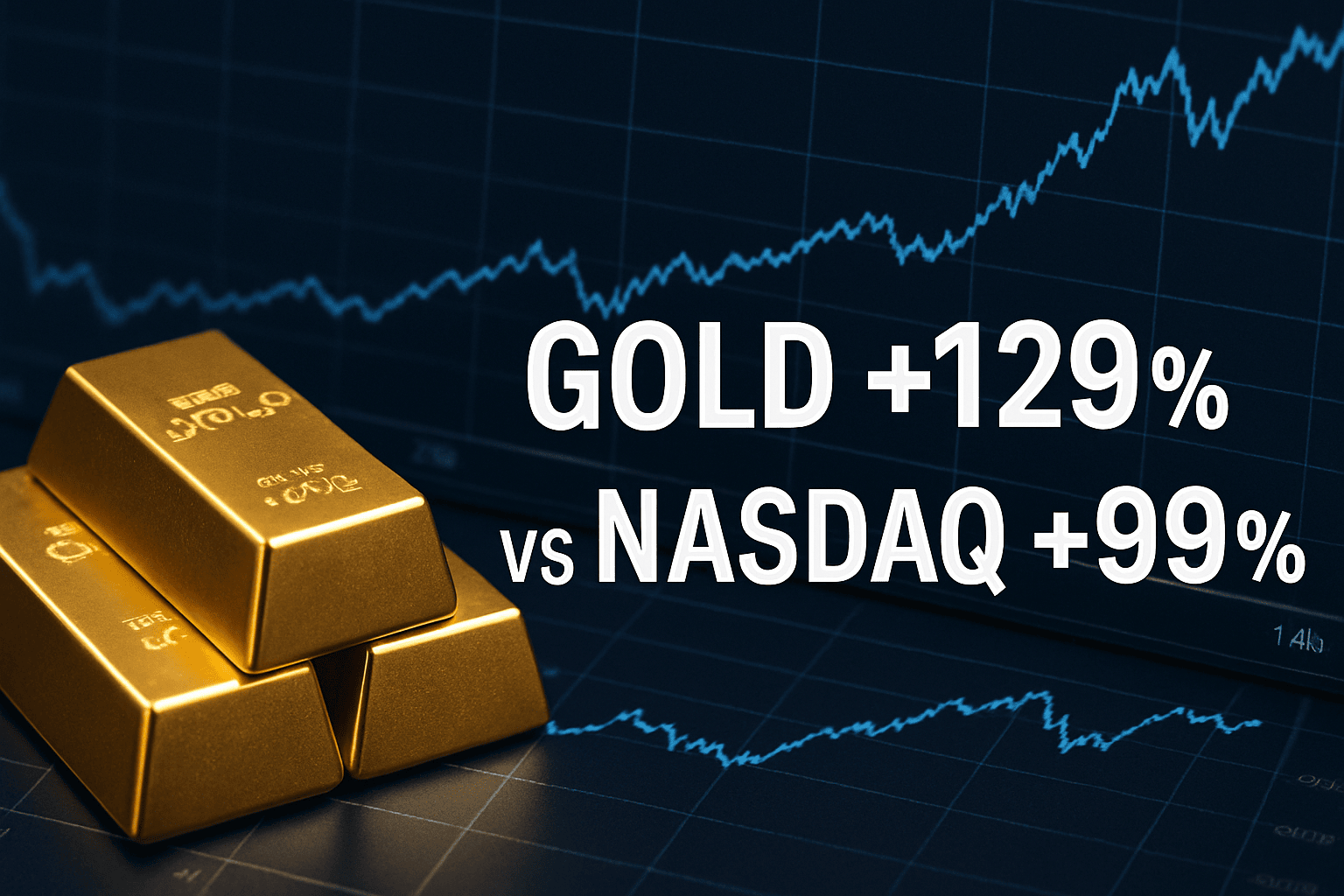

“Boring” Gold Beats Nasdaq by 30% Over 5 Years

Daily News Nuggets | Today’s top stories for gold and silver investors

October 17th, 2025

Gold Quietly Outruns the Nasdaq Since 2020

Most people think of gold as the boring investment — it’s not as fun as bragging about the latest tech stock at a dinner party. But here’s the surprise: over the past five years, gold is up 129% versus 99% for the Nasdaq Composite.

While megacap tech dominated headlines, gold quietly compounded with low correlation to equities and zero drama. In a cycle defined by rate shocks, bank scares, and geopolitical flare-ups, gold’s defensive bid didn’t just keep pace with high-flying tech — it beat it.

Start dates always matter and future returns aren’t guaranteed, but the message is clear: a strategic allocation to gold can carry more of the portfolio’s load than most investors expect. Even if it doesn’t make for exciting cocktail-party chatter.

And right now, that defensive appeal is getting a major stress test…

Bank Stocks Tumble as Haven Bids Surge

Financials took a beating Thursday as stress in US regional lenders spilled into Europe, knocking major bank shares and sending volatility higher. The risk-off wave pushed gold to an all-time high above $4,370/oz and pulled Treasury yields lower as traders priced in deeper Fed cuts.

It’s the classic liquidity-scare playbook: banks wobble, equities get shaky, the dollar softens, and safe-haven assets catch a bid. If pressure on regional lenders persists — or spreads — expect the flight-to-quality trade, including gold, to stay well-supported. Wall Street strategists are starting to take notice — and revise their targets upward…

HSBC: Gold’s ‘Bull Wave’ Could Crest at $5,000 by 2026

HSBC made waves this week with a bold new forecast: gold could hit $5,000/oz in the first half of 2026. The bank cites persistent central-bank buying, sticky geopolitical risk, prospects for lower US rates, and renewed investor demand via ETFs. It also raised its average price targets for 2025 and 2026 while flagging higher volatility ahead.

Translation: upside potential remains real, but the path won’t be smooth. Even in bull markets, gold can whipsaw. Position sizing and risk management still matter — especially as momentum builds.

While analysts debate price targets, Washington’s dysfunction is clouding the macro picture.

Shutdown Hits Day 17: Data Blackouts Deepen

Washington’s partial shutdown entered its 17th day Thursday, now the third-longest funding lapse in modern history. The Senate isn’t expected to reconvene until Monday, with the next vote aimed at reopening the government scheduled for Oct. 20. That prolongs the freeze on key government functions and delays the economic data investors rely on to gauge growth and inflation.

Opaque data complicates the Fed’s decision-making and keeps markets on edge. That kind of uncertainty tends to favor assets with no cash-flow assumptions, no counterparty risk, and no reliance on government statistics — namely, physical gold and silver. The longer the blackout drags on, the harder it gets for anyone to know what’s really happening in the economy. And markets hate flying blind.

Add it all up, and you get a financial system the IMF says is more fragile than it looks.

IMF Flags Elevated Financial-Stability Risks

The IMF’s latest Global Financial Stability Report warns that stretched valuations, sovereign-bond strains, and vulnerabilities in nonbank finance leave the system sensitive to sudden shocks. The concern isn’t just equity prices — it’s the plumbing underneath. When uncertainty spikes, the IMF notes, currency and funding markets can seize quickly, tightening conditions across asset classes and amplifying volatility.

Translation: the system is running on thinner margins than it looks. Leverage is elevated, liquidity buffers are slim, and correlations tend to spike when stress hits — meaning diversification can disappear right when you need it most.

For investors, that’s a reminder to stress-test allocations and keep real portfolio ballast on hand. Historically, gold has played a dual role as both a liquidity reserve and a tail-risk hedge when volatility clusters. It’s not thrilling, but it works when the pipes freeze up.

Post Comment