‘A Cloud has Lifted’ on the ETF Regulatory Front

The ETF industry is expecting some big shakeups under the second Trump administration on the regulatory front in which they expect an SEC to be less focused on enforcement while moving faster to approve dual-class structures for dozens of asset managers as well as an openness to continued innovation in crypto and private market ETFs.

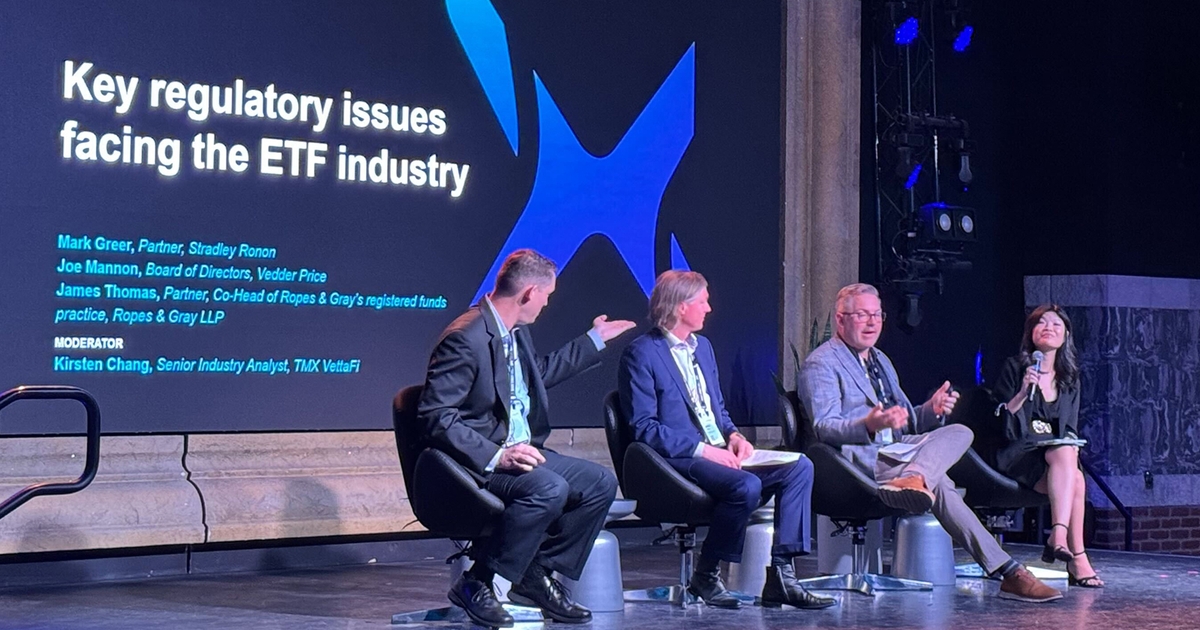

Those were some of the themes that emerged from a session focused on key regulatory issues facing the ETF industry at the Exchange Conference taking place this week in Las Vegas.

“A cloud has lifted,” said Joe Mannon, chair of the private fund formation group with Vedder Price. For the past decade, Mannon said a lot of SEC enforcement actions have amounted to penalizing “technical violations” rather than primarily focusing on cracking down on actual fraud and bad actors. He expected the regime change at the SEC to reverse that trend. (The discussion took place amid news that about 500 SEC staffers had accepted buyout and deferred-resignation offers.)

“If you are an SEC staffer, it’s not great,” said Mark Greer, partner, Stradley Ronon. “For the industry, we are getting more certainty. There’s been a ‘regulation by enforcement’ vibe for the last decade” that is now lifting.

“This is a generational opportunity to have dialogue” with the SEC, he said.

One of the more significant issues the panel expected to see the SEC move on is approving so-called dual-class structures, which would enable asset managers to offer ETF and mutual fund share classes on the same funds. Vanguard has used this structure for years, but its patent expired in 2023. Since then, more than 50 asset managers have petitioned the SEC asking for permission to enact the structures. Recently, SEC Commissioner Mark Uyeda signaled that the issue is a “top priority.”

However, it’s unclear what that means for timing. The panelists’ views varied, with some expecting approval by the end of the year, while Mannon said it could come as soon as the end of the second quarter.

“That is the holy grail,” Mannon said. “What’s fascinating is the SEC is laser-focused on getting this done quickly. The government historically does not work quickly. The SEC does not work quickly. But I can see SEC going light speed on this and the industry being left backfooted.”

Other panelists echoed that concern, wondering if even the asset managers who have petitioned for approval to use the structure are operationally prepared to implement it if they gain SEC approval.

“It could be a ‘what if the dog caught the car?’ moment,” Greer said. “The worst thing is if we get this and you are not ready. You have to make sure operations, back offices and compliance are already talking.”

“The real concern has been that (the dual-class structure) might not be fair to either the mutual fund or ETF shareholders,” added James Thomas, partner, co-head of Ropes & Gray’s registered funds practice. “If you think about the costs from an ETF share class perspective, you are going to have a cash drag from the mutual fund side to deal with redemptions. That’s one issue.”

Another area where the SEC could be active is greenlighting additional private market ETFs in the wake of State Street’s launch of the SPDR SSGA IG Public & Private Credit ETF. The SEC approved the fund’s novel mechanism, in which the ETF directly holds private credit that Apollo is obligated to buy as necessary to keep the fund liquid.

To date, no other asset manager has filed for a similar fund. Other private markets-themed ETFs take different tactics, such as investing in companies that operate in private markets (such as BDCs) and constructing indexes of public companies that mimic private market strategies or holding products like CLOs.

One mechanism that could open the floodgates is the SEC currently obligates funds that sell to retail investors to cap illiquid exposures at 15%. Anything higher is currently only open to accredited investors and above. The panel speculated the SEC could potentially lift that level, making it easier for ETFs to hold illiquid assets directly, but by doing so it could introduce a real liquidity mismatch by having fundamentally illiquid assets being held in a fully liquid wrapper. Issuers would figure out how to navigate that liquidity mismatch (a la the State Street/Apollo mechanism) as well as how to provide more frequent valuations of an asset class that typically is not valued daily.

“These are private investments that tend not to trade, so you can’t price them the same way,” Thomas said. On liquidity, the Apollo solution is “not easily scalable unless you have that willing buyer.”

In addition, even between private market assets, liquidity levels vary slightly. Private credit is the most liquid and it’s easier to provide more frequent valuations compared with private equity or real assets.

“There’s a market for private credit, and there are cash flows,” Mannon said. “For private equity, you are further removed. How do you do valuations?”

Lastly, on the crypto ETF front, 2025 has already brought dozens of new applications for funds, including spot ETFs for tokens beyond Bitcoin and Etherium, multi-asset crypto ETFs that include a blend of tokens, leveraged products and buffered funds.

“Managers are figuring out how hard they can push,” Mannon said. He predicted managers could push the envelope and even introduce products that eventually blow up and require enforcement action.

Post Comment